BC mining property faces possible rebirth

A gold-mining firm hopes to gain approval for an underground mine at British Columbia’s iconic Kemess property

An intermediate Canadian gold-mining company hopes to breathe new life into an iconic British Columbia metal-mining property as early as two years from now.

Harold Bent, director of environment for AuRico Gold Inc., said his company filed a project description for its Kemess Underground Project with the Canadian Environmental Assessment Agency and the British Columbia Environmental Assessment Office this past February 12.

AuRico expects to hear from the government agencies on April 7 concerning what the review process will be, Bent said.

The Kemess Underground Project is a proposed copper/gold mine located 250 kilometres north of Smithers. It is also just 5.5 kilometres north of the Kemess South open-pit mine, which produced nearly 3 million oz. of gold and more than 700 million lb. of copper during its 1998-2011 lifetime.

Bent said he expected the environmental review process to take about two years. He also said his company is committed to building the mine.

“Absolutely,” he said. “We want to take this through the review process, we want the (environmental assessment) certificate, and we want to build it.”

A redesigned proposal

Bent also said AuRico has some advantages as it enters the environmental assessment process. The previous owners of the Kemess property, Northgate Minerals Corp., had a Kemess North open-pit mine proposal rejected by a joint provincial and federal review panel in 2007.

After AuRico purchased Northgate and acquired the Kemess property in 2011, it redesigned Northgate’s proposed open-pit mine as an underground block cave operation. An increase in metal prices made the changes affordable.

Using the underground mine option as opposed to the open-pit one, AuRico could reduce a mine’s surface disturbance from 980 hectares to 65. As well, the company could cut the tailings and waste rock produced from 750 million tonnes to 102 million.

Also, in the underground mine proposal, the reduced amount of tailings and waste rock could be dumped into Kemess South’s mined-out open pit. Not only is such a use already permitted, but the pit is also big enough to hold the expected volume, Bent said.

Previously, Northgate was proposing to dump its open-pit option’s 750 million tonnes of waste into nearby Amazay Lake.

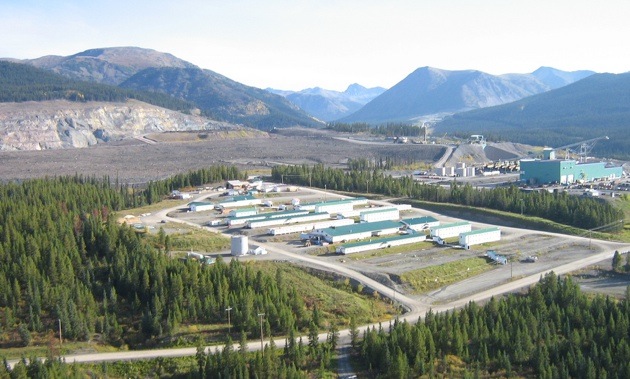

Existing infrastructure can be used

The existing pit represents another advantage AuRico’s proposed mine has, Bent said. It’s just one of several facilities already built at Kemess South that can be utilized by a new mine.

The Kemess South property—currently on care and maintenance—also features an existing mill, an administration complex, camp accommodations that can hold up to 300 people, a 1.5-kilometre all-weather airstrip, and is the terminus for a company-owned, 380-kilometre-long (230-kV) power line, among other features.

The existing infrastructure is vital to AuRico as it looks at the viability of constructing an underground mine.

“It’s incredibly important,” Bent said. “We value the asset that’s currently set at almost $750 million. So that is a huge opportunity for us… If we started from scratch, we’d have to spend another $750 million.”

Currently, the underground mine AuRico is proposing would take five years to construct, operate for 12 years, and undergo a three- to five-year reclamation process. Overall production would total 1.3 million oz. of gold and 563 million lb. of copper. The capital cost is estimated at $500 million.

The underground block cave operation AuRico is proposing would work by allowing ore to collapse under its own weight. Workers would build tunnels under the 540-metre-long, 230-metre-wide ore body and large machines would scrape the ore from below, letting it fall down into the main tunnel.

The ore would then be removed, crushed and placed on a conveyor taking it to the Kemess South mill. The ore body is located only about 150 metres from the surface.

First Nations partnerships

AuRico has also made substantial progress in getting area First Nations on side with its proposed development.

On June 22, 2012, the company signed an Interim Measures Agreement with the three First Nations bands whose traditional territories overlap the mine property. The bands who signed include the Tsay Keh Dene, Takla Lake and Kwadacha bands, who collectively identify themselves as the Tse Keh Nay.

The IMA gives the bands access to business, training and employment opportunities concerning the mine, Bent said. It’s also viewed as 80 per cent along the way towards completion of an Impact Benefit Agreement.

Bent said if the mine is approved, the company will need to employ up to 400 people to build it during height of construction. Another 325 to 350 will be needed during operations.

He also said an exploration drilling program will continue around the Kemess Underground Project deposit this summer.