The M&E DISPATCH // 151

The Medium Countries, Part 9: The Supply Chain Wars – How Critical Minerals Became the New Sanctions Regime

THE DISPATCH

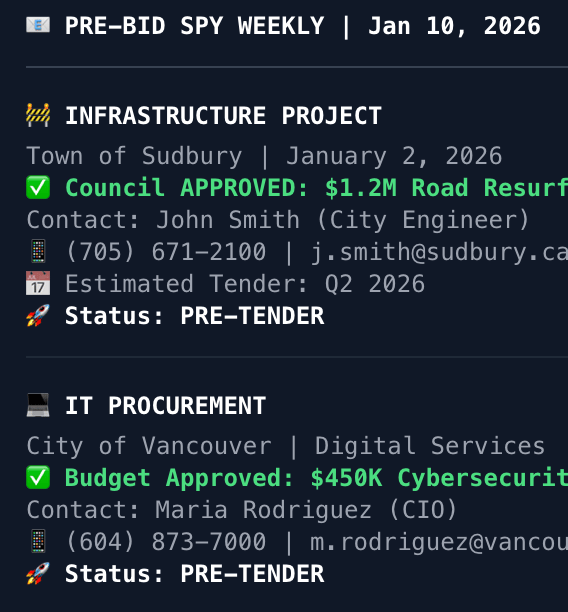

Featured CompanyThe PIP! is a procurement intelligence platform that monitors municipal council meetings across Canada to identify funded opportunities before they become public tenders. By providing early access to project details and decision-maker contact information, Pre-Bid Spy helps businesses build relationships and win contracts before the competition even knows they exist. |

Part 9 of a 10 part series on the global reshaping.

The rise of the Medium Countries.

“Critical minerals” have quietly moved from climate jargon to the centre of security policy. The U.S. now hosts a Critical Minerals Ministerial at State, not Environment, and has tied minerals to national security in a new executive order on **“processed critical minerals and their derivatives.” China has already shown how sharp this tool can be, tightening exports of gallium, germanium, graphite and rare earths whenever disputes flare.

The result is a new kind of sanctions regime where supply chains themselves are the weapon. Nobody needs to ban EVs or wind turbines outright if you can squeeze the materials and processing capacity they rely on.

From Tariffs to Chokepoints

Old‑school pressure used tariffs, quotas and embargoes. The 2026 playbook goes further. Washington’s latest order lets the president curb or condition imports of processed minerals on security grounds, explicitly targeting segments where China dominates refining. Beijing, for its part, has used export controls on gallium, germanium and graphite, plus tighter rare‑earth management, as precise levers in specific rows.

Analysts now talk about critical minerals as “asymmetric” assets because policy, not geology, increasingly decides who wins. Sanctions look less like press conferences and more like licence delays, origin rules, and security reviews that quietly reshape who can buy what from whom.

Canada’s Move: Redraw the Export Map

Canada’s answer is to change the map, not the physics. Carney’s 2026 trade strategy stakes out a clear goal: double exports to non‑U.S. markets by 2035. The plan leans on three pillars:

Leverage the geology – 30‑plus critical minerals, from lithium and nickel to potash and uranium, as bargaining chips in multiple directions, not just south.

Build the plumbing – ports, rail, transmission and terminals to move those volumes to Europe, Asia and the Gulf.

Embed in alliances – the U.S.‑led Minerals Security Partnership, EU’s SAFE/CRMA, India and Gulf corridors, and G7 frameworks that lock supply into political relationships.

That’s why you keep seeing Canada in rooms like the 2026 Critical Minerals Ministerial in Washington: we’re positioning our minerals inside many partners’ strategies so no single chokepoint can be turned entirely against us.

Medium Countries Lean In

Other medium‑sized resource powers are running the same playbook:

Chile uses copper and lithium to demand more local processing and better terms.

Australia tightens screens on Chinese investment while courting Japanese, Korean, U.S. and EU capital.

Indonesia uses nickel export bans and downstream rules to force smelter and refinery build‑out.

The through‑line: offtake and JV choices are now geopolitical decisions, not just pricing questions. Canada’s deals with Europe (SAFE/CRMA), India, and the Gulf all reflect the same question: who do we want to be tied to when things get rough?

Why It Matters on the Ground

For projects and portfolios, this isn’t academic:

Offtakes will increasingly hinge on origin, ESG, and alliance politics as much as volume and price.

Security reviews will slow and complicate deals involving strategic buyers or sensitive destinations.

Capital stacks built around a single state‑backed source may narrow your future customer base if that state is treated as a rival elsewhere.

The upside: well‑located assets in trusted jurisdictions become more valuable precisely because they can plug into multiple supply‑chain strategies. The downside: anyone still treating critical minerals as just another commodity is going to discover, the hard way, that in 2026 the real sanctions list is the one written into your supply contracts.

// THE DIRT

FEATURED RELEASEDo you have a release you want to make sure is covered? Here’s the spot for it. Hit reply and I’ll fill you in. |  FEATURED STORYHave a story or update you want covered? Here’s the spot for it. Hit reply and I’ll fill you in. |

A Closing Thought

NOTES FROM THE NORTH

The kids are gone on a road trip to Ottawa and Quebec this weekend, with today’s game being a late 8pm start they’re using the morning to go for an easy skate on the Rideau Canal. That’s a Canadian Bucket List experience for them, not sure if they all know it yet though 🫠

I’ve been having some great conversations around ThePip.ca this week and I keep getting asked if I can do some of this automation stuff for the companies that I’ve talking to, so I’ve put together a service to help with integrating AI into your company.

If you’ve had questions around using AI in your company and not sure what that would look like, send me a message and we can chat.

-Lee

Nostalgia - The feeling you get when your youth says hello.

Content Aggregated from External Source

This article was automatically imported from an RSS feed. The content and accuracy are the responsibility of the original publisher.